Adding Fuel to the Raging Value Debate Fire

For both Fundamental and Quantitative investors, hardly a month goes by without an update to the great Value debate. The latest shot across the bow comes from a paper published by Sparkline Capital in which they theorize that the demise of the Value factor is due to the underestimation of the effects of technology disruption in traditional capital markets. Sparkline Capital breaks out the FAAANM stocks (Facebook, Apple, Alphabet, Amazon, Netflix and Microsoft) from the rest of the S&P 500 to analyze FAAANM sector performance along with the remaining S&P 500 ex-FAAANM stocks. They leverage machine learning technologies to expand the analysis and create a “Tech Disruption Factor” that is agnostic of sectors, which performs strongly and carries a negative exposure to Value.

In this issue of Factor Spotlight, we’ve run our own variation of the analysis on the FAAANM and ex-FAAANM portfolios and apply a commercially available factor risk model on these portfolios using the Omega Point platform. We humbly don’t enter the Value debate fray, but attempt to shine a different lens on it.

Portfolio Construction and Initial Analysis

To build the FAAANM model we simply take Facebook, Apple, Amazon, Alphabet, Netflix, and Microsoft and cap weight them on a monthly basis. To build the S&P500 ex-FAAANM we remove these names from the S&P500 and re-normalize the remaining names back to 100%.

Below we compare the Value exposure of FAAANM and S&P500 ex-FAAANM relative to the S&P500 benchmark over the past 20 years. As expected, the FAAANM portfolio carries a sizable anti-Value tilt, however, we note that the portfolio has become progressively less anti-Value over time.

We also highlight below the last decade’s worth of Value’s factor returns. We see it has been a mixed bag with some ups and downs, ending down -4.86% despite some recent attempts to rally back up. While this chart isn’t as long-term as French’s, we still see the doldrums in this factor’s performance.

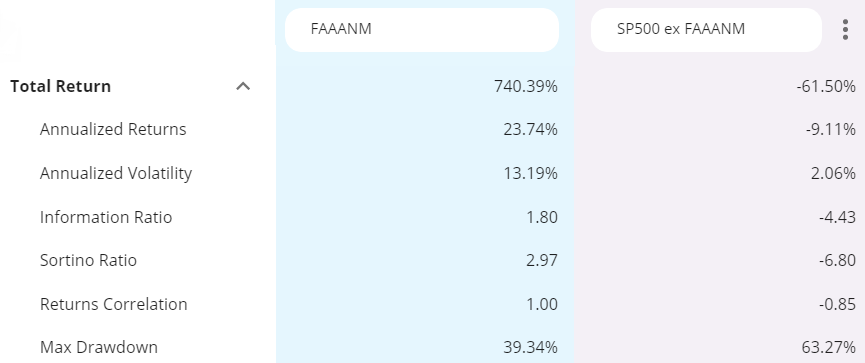

We also observe the cumulative active performance of FAANM and S&P500 EC-FAANM over the S&P 500 benchmark over the past decade.

FAAANM stocks over the last decade make up all of the S&P 500’s returns and more than compensate for the S&P 500’s losers.

We see much lower realized volatility from the S&P500 ex-FAAANM portfolio, but that is to be expected given the breadth of names held relative to the 6 FAAANM names. From the risk perspective of “don’t lose capital” - we see the FAAANM portfolio has a much lower Max Drawdown over this time period.

We also observe the contribution of Value to these portfolios. As seen above, the factor return for Value has been underperforming, and thus the underweight in Value actually helped the FAAANM portfolio.

Below is the total predicted risk of these two portfolios:

At the beginning of April 2020, we actually see that the 6 asset FAAANM portfolio actually has LOWER risk than the other ~500 assets in the S&P 500! Whatever happened to diversification helping to reduce risk!?!?

A Deeper Dive into Risk

To better understand the drivers of these risks, we take the FAAANM portfolio and measure it relative to the S&P500 ex-FAAANM. Below are the high level risk drivers over this time period, where we see two major shifts in risk trends:

Towards the end of October 2013, we see that Specific risk starts to become less and less of a risk driver, and Sector risk starts increasing relatively dramatically from where it started. In May 2019, we see the Sector risks start to drop off, Specific risks pausing before dropping during the COVID crisis, and Style risks really taking off and driving the active risk in these two portfolios.

Here’s the latest snapshot (8/13/20) of the highest active risk drivers of the FAAANM portfolio relative to the S&P 500 ex-FAAANM:

We see that over 20% of the active risk is coming from Medium-Term Momentum alone! While Medium Term Momentum has on average performed positively over time, it’s also a factor that “goes up on the escalator and down on the elevator”, suggesting potential downside risk in the FAAANM portfolio if Medium-Term Momentum were to ride the elevator to the basement.

And this downside risk, not only from Medium-Term Momentum but also stock-specific, could be justified. Typically, low Value stocks are justified by both Growth potential and Profitability. Below we expand our analysis of the two portfolios to their exposure to these two factors:

Growth Exposure - Trailing 10 Years

Profitability Exposure - Trailing 10 Years

We see that over this time period the FAAANM portfolio has had a much higher exposure to both Growth and Profitability, although this has steadily been decreasing. The question is, will the markets still be interested in paying a premium for FAAANM stocks with degrading fundamental characteristics? If this does happen, will the FAAANM stocks drag Medium-Term Momentum down with them? Or is the tech disruption from these names only the beginning and the world needs a new definition of “Value” where disruption potential is taken into account? The jury is still out with the final verdict still pending, and bets being made on both sides. Regardless of your positioning, being factor aware in your portfolio construction and risk management is as important as ever.

US & Global Market Summary

US Market: 8/10/20 - 8/14/20

- The markets ended up for the third week in a row, as earnings season started to cool down and investors digested the stalemate in DC over the fifth COVID relief bill and tried to auger the legality and efficacy of Trump’s executive orders.

- Congress and the White House remained at loggerheads with regard to a coronavirus relief agreement, as financial lifelines for millions of Americans expired.

- Retail sales in July rose by +1.2%, below the consensus estimate of 2.3%, and well below June’s increase of +7.5%.

Normalized Factor Returns: Axioma US Equity Risk Model (AXUS4-MH)

- Volatility continued to recover from a trough of -2.18 SD below the mean on 8/4, exiting Extremely Oversold territory as it saw the biggest normalized gains for the week.

- Market Sensitivity saw another week of solid gains as it climbed out of Oversold space.

- Momentum hit a peak of +1.95 SD above the mean on 8/6 and then saw a steep reversion, falling 0.4 standard deviations in the past week.

- Growth was the week’s biggest loser, dropping deeper into negative territory by 0.58 standard deviations. We simultaneously saw a slight positive move in Value as it headed towards the mean.

- US Total Risk (using the Russell 3000 as proxy) declined by 25bps.

Normalized Factor Returns: Axioma Worldwide Equity Risk Model (AXWW4-MH)

- Profitability was the top performer globally for the third week in a row, shooting up +0.6 standard deviations and earning an Overbought label at +1.09 SD above the mean.

- Market Sensitivity exited Oversold space as it again saw slight gains as it climbed back towards the mean.

- Volatility also saw a slight gain of +0.14 SD as it sought to shed its Oversold label.

- Similar to the US, we saw a rotation out of Growth and into Value, with the latter up +0.19 SD and shedding its Oversold designation.

- Growth, on the other hand, fell by 0.4 SD as it declined towards Extremely Oversold territory.

- Momentum continued to fall from a peak of +2.58 SD above the mean on 8/5, leaving Extremely Overbought space as it declined by -0.64 SD.

- Global Risk (using the ACWI as proxy) declined by 27bps.

Regards,

Chris