Mitigating Election-Driven Volatility In Your Portfolio

In our prior Factor Spotlight, we observed that in a Presidential Election month, US market volatility* is 15-25% higher on average than any other month.

We also observed that in the Presidential Election November months, the factor contribution to US market volatility is 68% higher than Non-Election Novembers. Drilling down further, we see that the biggest contributor by far to this increase is the Market Sensitivity (Beta) factor, which is a measure of a security’s trailing 1-year beta to the US market.

This finding is both intuitive and empirically makes sense -- the increase in volatility during Presidential Elections can be potentially mitigated through the creation of instruments that target the Market Sensitivity (Beta) factor. Below, we will introduce our design methodology for the creation of factor-targeting baskets, and will examine the characteristics of a beta-sensitive factor basket.

Design Methodology to Create A Factor-Targeting Basket

We leverage an intuitive and repeatable framework for the creation of any factor basket through our platform. As shown in the diagram below, the process is largely 3 steps:

- Build Tradable Universe — for the purposes of this example, we start with the Russell 3000 and filter out small cap and low liquidity names. We can utilize the same framework for any universe (sector-specific, country, large-cap, small-cap, and any combination thereof).

- Create Equal-Weighted Market Factor-Targeting Portfolio — Leveraging the factor exposure of each security, we select the securities in the Top Quintile (20%) of the tradable universe and build an equal-weighted long portfolio. We then repeat the same process with the securities in the Bottom Quintile (20%) of the tradable universe. Finally, we combine the top and bottom portfolios into a long-short equity market neutral portfolio. This process can be adjusted to use the top Decile (10%) , Quartile (25%), Tercile (33%), etc... of the tradable universe. We can also disaggregate the long and short portfolios to allow for a long-only or short-only implementation.

- Purify Factor-Targeting Portfolio — many other approaches stop at step 2. We add an additional step that leverages our SmartTradeTM technology to “purify” the portfolio of as many unintended exposures that come with the equal-weighted approach. The net effect is that any security’s weight can be adjusted from its original position as long as the sum of the weights of all securities in each of the Top and Bottom portfolios still equal 100%.

This approach is very repeatable and can be automatically applied to rebalance periodically (e.g. monthly) or more frequently if the factor characteristics of the securities changes quickly. Let’s examine how this approach works for the construction of a Beta-Targeting basket.

Beta-Targeting Basket

We examine our Beta-Targeting basket, built as of October 14th, 2020, by taking a look at the some of the basic properties of the equity-market neutral portfolio as a whole, as well as the long and short legs separately.

We observe that the total portfolio has 392 securities, though almost 2:1 Long/Short ratio. That’s due to the SmartTradeTM purification step, which reduces the weights to 0 for some of the securities that are contributing too many other unintended factor exposures relative to their contribution of Beta exposure.

From a high-level sector perspective, we can see that the High Beta (LONG) portfolio is overweight Consumer Discretionary, Industrials, Financials, Real Estate, and to a lesser extent Health Care. The Low Beta (SHORT) portfolio is overweight Healthcare, Consumer Staples, Information Technology, and Consumer Discretionary, and to a lesser extent Communication Services.

The picture becomes more clear when we drill down into Industry Groups and Industries. Now we can see that the High Beta (LONG) portfolio is weighted towards Retail, Real Estate, Hotels/Restaurants, and Healthcare Services while the Low Beta (SHORT) portfolio is weighted towards Pharma/Biotech, Food & Staples, Software, Healthcare Equipment, and Utilities. This weighting seems to match our intuition for the COVID-driven economic environment,

Now let’s take a look at how well the basket targets the Market Sensitivity (Beta) factor:

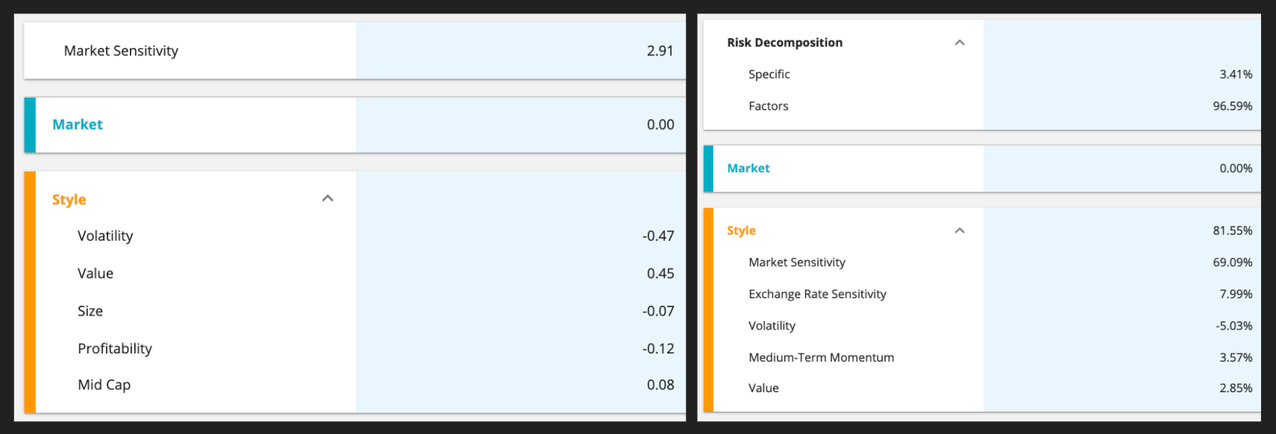

From the table on the left, we see that the basket has an exposure of almost 3x (2.91) to the Market Sensitivity factor. That means that if the Market Sensitivity factor moves up or down by 1%, the Basket is expected to move up or down by almost 3%. This gives the investor inherent leverage, meaning that for every $1 of beta protection, the investor only needs to put on ~0.33 of the basket to get a full hedge.

We also see that the basket carries other factor bets, like Volatility and Value, but we further observe in the Risk Decomposition table to the right that Volatility is actually risk reducing (-5%), and Value is only 2.85% of the predicted risk of the basket. As expected Market Sensitivity makes up the bulk (69.09%) of the predicted risk of the basket.

Final Thoughts

An investor looking to achieve a higher/lower Beta hedge ratio or a higher %Risk from the Beta factor can certainly adjust the SmartTradeTM parameters to achieve these goals. Following a robust process as outlined in our webinar Quantitative Evaluation of Hedge Baskets can ensure that the hedge is stable and the asset mix is desirable.

Now that we’ve laid out the foundations of our Factor-Targeting methodology and took a look at election-driven volatility, we have an exciting treat in store next week when we apply this methodology to create thematic baskets most relevant to the upcoming 2020 US presidential election. With investors increasingly on edge as the third of November draws nearer, you certainly won’t want to miss what we uncover!

US & Global Market Summary

US Market: 10/12/20 -10/16/20

- The market was flat to slightly down on the week, as stocks gave up early gains on Friday to end up flattish in the light of disappointing labor news and positive data on retail sales.

- Employment data was the albatross, as US jobless claims landed at 898,000 on a seasonally-adjusted basis, higher than consensus expectations of 825,000, indicating that the economic recovery is not as sanguine as previously thought.

- Pfizer (PFE) suggested it might file for emergency use authorization from the FDA by late November for the COVID-19 vaccine it’s co-producing with BioNTech (BNTX). At the same time, Eli Lilly (LLY) and Johnson & Johnson (JNJ) announced setbacks for their respective vaccine trials, while Gilead Sciences’ (GILD) remdesevir treatment was found to have no impact on survival for patients who had contracted the coronavirus.

- Retail sales rose +1.9% in in September over August, doubling consensus expectations for a +0.8% increase, which were 5.4% YoY.

- Meanwhile, rising COVID cases in the midwest and new travel restrictions across Europe lent additional stress to investors, as well as stalled talks around the US stimulus package.

Normalized Factor Returns: Axioma US Equity Risk Model (AXUS4-MH)

- Momentum continued to rally, crossing into positive territory after hitting a recent bottom of -0.85 SD below the mean on 9/21.

- Growth exited Oversold space last week and gapped up towards the mean after touching bottom at -1.92 SD below the mean on 9/18.

- The upwards trend in Profitability continued as it shed its Oversold label and reverted towards the mean.

- Earnings Yield has started to revert from a peak of -1.53 SD below the mean on 10/7 and saw some bounce, sitting at -0.86 SD above the mean.

- Size continued to lose ground on a normalized basis this week, down -0.27 SD.

- US Total Risk (using the Russell 3000 as proxy) declined by 42bps.

Normalized Factor Returns: Axioma Worldwide Equity Risk Model (AXWW4-MH)

- Momentum continued its upwards acceleration as it neared the mean with a +0.48 SD move.

- Growth saw strength as it climbed back into positive space, now at +0.38 SD above the mean.

- Exchange Rate Sensitivity enjoyed another positive move this week, up 0.35 standard deviations.

- Earnings Yield saw continued weakness as it fell another -0.3 SD and now sitting close to perfectl neutral after being +1.53 SD above the mean on 10/7.

- Global Risk (using the ACWI as proxy) declined by 49bps.

Regards,

Omer