Quantifying the Impact of Russia’s Incursion into Ukraine

Russia's launch of a long-feared invasion of Ukraine early on Thursday morning marked a significant escalation of the ongoing Russo-Ukrainian War, sending shockwaves worldwide and across the global financial markets. Further turmoil seems inevitable as Kyiv braces for a siege, sanctions against Russia cascade, and sovereign rhetoric amplifies. Investors already struggling with inflation, Fed actions, global supply chain disruptions, and pandemic-related issues now need to further brace their portfolios as this crisis deepens and potentially broadens across the region and the globe.

We've built Omega Point to quant-enable investors as they navigate today's increasingly data-rich, factor-driven markets. To help the investment community interpret the impact of this escalating crisis, this week, we will leverage the Omega Point platform and apply multiple risk lenses from our data partners to help bolster our analysis.

Multiple Models Provide Clarity on a Murky Situation

When major market shocks occur, it is advantageous to use multiple models and factors to expand our ability to evaluate the market impact and find clear trends that persist across markets. For this week’s analysis, we leveraged Omega Point’s 'Unified Data Cloud'™ to survey hundreds of factors across models from our partners at Wolfe Research, Qontigo, and MSCI.

The following risk models are included in our analysis:

To effectively analyze many factors across different models, we normalized the 1-day factor moves on Feb 24, 2022, by the expected volatility of the factors. This approach allows us to isolate the factors most sensitive to the events of Feb 24, as prior investor expectations of an escalation would have translated into the expected volatility of the factor.

The chart below summarizes the top style factors that exceeded a 2-standard deviation performance move on Feb 24, 2022. Of the ~150 style factors analyzed across the seven models, 37 factors had at least a 2-standard deviation move.

Substantial and consistent trends emerged across all of the models, which gives us high conviction in the conclusions drawn from this analysis. Below, we summarize the overarching trends that underscore investors’ outlook on the back of the Russia / Ukraine crisis escalation.

Markets rotate into US assets, move away from Europe-sensitive names

Starting with the Beta category, we see strong outperformance for the US beta factors, which describe stocks with high sensitivity to the US market. Conversely, we see substantial underperformance for the Developed Markets ex-US beta factors. These factor moves represent movement into US & US-sensitive stocks that may serve as a near-term haven in concert with movement away from Europe & Europe-sensitive companies.

Value-Growth rotation reverts, with investors moving into defensive positioning

Our recent headliner Growth vs. Value also has a thread in Thursday’s market move. We’ve been in the midst of a value-driven trade, but this shock to the market may be pushing investors back towards more growth-driven, defensive positioning. In broader terms, we see underperformance in the US and Global Value factors across all models(except for the Global Book-to-Price from the Barra Global model). Conversely, the US, Global, and Emerging Markets Growth factors all saw significant outperformance, further underscoring the potential slow-down of the value-growth rotation. Similar to what we saw in the early days of the 2020 pandemic, the shift is signaling that the market is concerned about increased risk and slowing economic growth due to sanctions and potential drop-off in consumer demand.

Investors signal worries of slowing economic growth alongside oil supply shocks

The story becomes even more apparent when we analyze the moves of the macro and credit factors. On the macro side, we saw significant downshifts in the Carbon Emissions factor from the Axioma Macro model and down moves in the Oil & Interest Rate Beta factors from the Wolfe US and DM models. Again, these moves highlight that investors are likely worried about global growth slowing and even a potential recession. Though central banks are still signaling intentions to raise rates in the battle against global inflation, there has been speculation that the rate hikes will be less aggressive than initially priced into the market. This sentiment is evident in the sharp downward move in Interest Rate Beta. The down move in Oil Beta supports this narrative, with investors likely concerned about impending slowing global growth creating conditions for an oil crash, similar to the 2008-09 period during the Global Financial Crisis.

Markets move away from highly levered, credit-sensitive names

We see a ← 4 standard deviation move in the Axioma European BBB bond price factor and ← two standard deviation move in the Axioma US BBB bond price factor, signaling investors' expectations in pricing in increased credit risk. Consequently, we see investors selling off highly levered companies in Developed Markets ex-US and Emerging Markets, as reflected in the <-2 standard deviation move in Axioma Leverage factors.

Sector Lens Solidifies Regional & Defensive Rotation

Reviewing the industry factors gives us a more comprehensive picture of the market reaction.

Below we see further evidence of a defensive vs. cyclical trade with rallies in Information Technology, Health Care, and Utilities factors and a sell-off in Financials due to renewed speculation around inflation and central banks stepping back from their aggressive rate hikes.

That said, there are clear nuances with this particular environment that differentiate it from historical defensive/cyclical rotations. Consumer Staples, for example, seems out of place given its historical place as a defensive sector. In addition, investors are likely pricing in supply chain issues stemming from the conflict driving prices for vital raw materials such as wheat, higher than the ability of the companies to pass them onto consumers.

There is certainly a regional dimension at play here, particularly in Energy, Real Estate, and Communication Services. While Energy was down in the US, both Developed ex-US and Emerging Markets Energy factors saw significant upward moves. This divergence could potentially point to the likely need for new suppliers of Energy, particularly in Europe and Asia, as sanctions against Russia will cut down immensely on energy exports to those respective regions. Although Communication Services and Real Estate were adversely affected in Developed ex-US and Emerging Markets, respectively, the US segments of these sectors tend not to be particularly impacted by Russia and thus showed robust performance.

Taking Action

As we observe the crisis play out over the coming days, we'll learn more about the ripple effects across the region and the globe. The current priority for many investors is to quantify exposure to Russia and, more broadly, Europe as a whole to understand the likely systematic performance implications the ongoing conflict will have on their portfolios. Next week, we will walk through concrete workflows that allow for that quantification and help managers better position their portfolios against at-risk names.

US & Global Market Summary

US Market: 02/22/22 - 02/25/22

- Wall Street saw a broad rally on Friday following a turbulent trading week as investors saw signs of potential slowing in anticipated rate hikes and turned eager to hunt down bargains despite the ongoing crisis in Ukraine.

- Stocks swung sharply during the shortened trading week with uncertainty about how much Russia’s invasion will push up inflation, particularly oil and natural gas prices, and drag on the global economy. For the week, the S&P 500 rose 0.8%, Nasdaq Composite was up 1.6%, and DJIA remained flat.

- U.S. economic data showed Americans sharply increased spending by 2.1% in January, exceeding expectations.

- The Federal Reserve’s top inflation calculator rose by 0.6% in January and showed the biggest yearly increase since 1982.

- Orders for durable goods rose 1.6% in January, doubling the 0.8% rise forecasted by economists.

- West Texas Intermediate crude fell 1.3% Friday, but still finished the week up 1.5%. Gold fell 2% on Friday for a weekly loss of 0.6%.

Normalized Factor Returns: Axioma US Equity Risk Model (AXUS4-MH)

- Medium-Term Momentum continues its month-long ascent up the charts crossing into positive territory and barely nudging out also hot-moving Growth for the week’s top spot.

- Market Sensitivity (beta) stopped short of a rare four-bagger this week atop the charts but continues to climb and closing in on the extremely overbought threshold.

- Size fell another 38 BPs showing last week’s unexpected drop was no fluke.

- Earnings Yield barely missed a fifth week as the biggest factor laggard but continued to drop and move closer to oversold territory.

- Value continues to spiral downward securing this week’s bottom spot.

- U.S. Total Risk soared 0.60% this week.

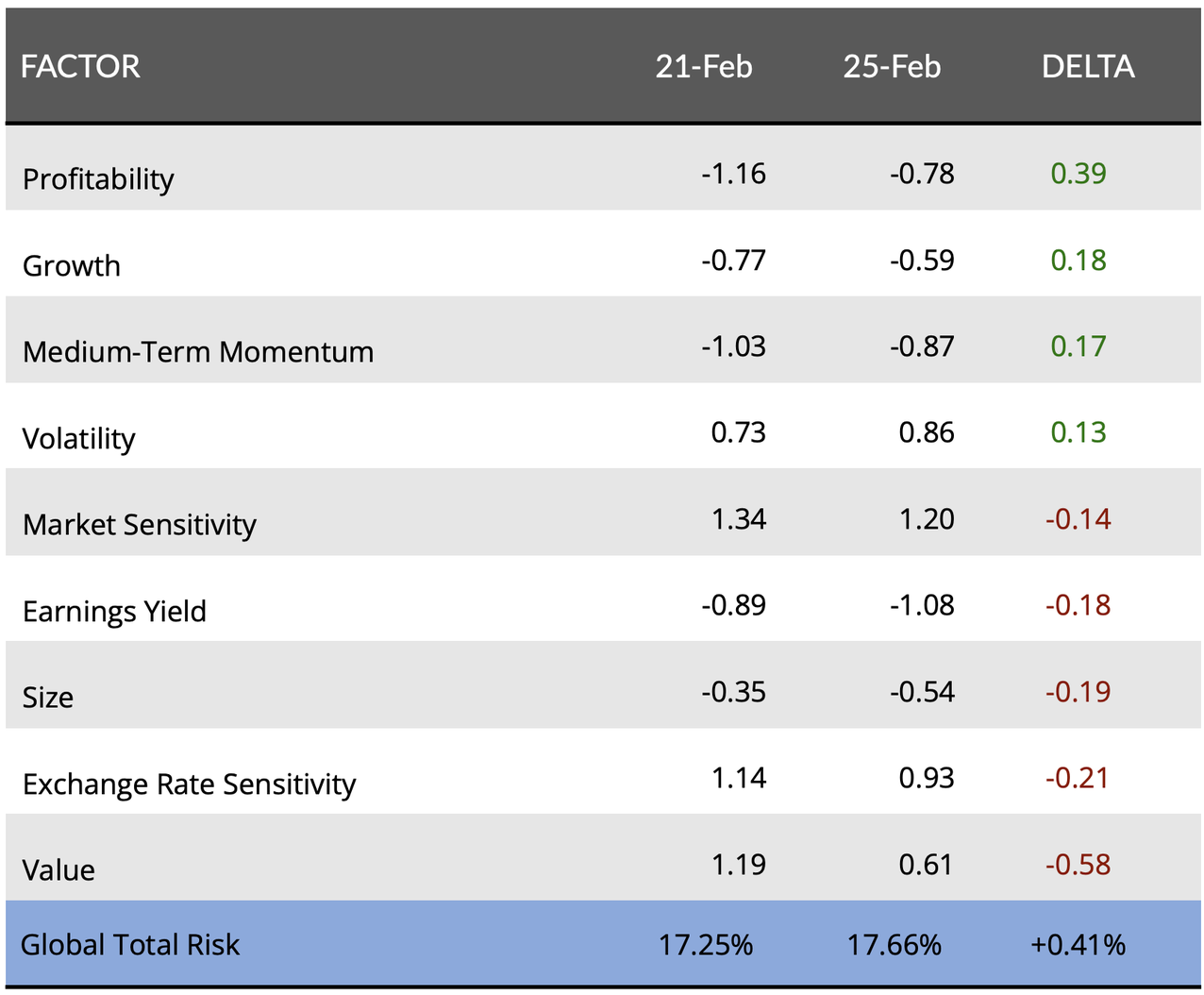

Normalized Factor Returns: Axioma Worldwide Equity Risk Model (AXWW4-MH)

- Profitability continued to build on last week’s strong showing to exit oversold status and secure this week’s top spot with comfortable margin.

- Growth maintains its ascent towards positive terrain and finishes strong as this week’s runner-up.

- Earnings Yield falls for the ninth straight week and crosses into oversold status.

- Size slides following signs last week of a slow-down in its upward momentum.

- Exchange Rate Sensitivity fell for a second week on the tails of its rocketing 2-month climb.

- Value finishes dead last for a 3rd consecutive week and officially exits overbought terrain.

- Global Total Risk climbed 0.41% this week.

Regards,

Omer